Introduction

As the cost of materials, transportation and labor rise globally, construction projects are feeling the bite of evaporating margins, constrained cashflow, and extended lead times. Moving into a post-COVID operational environment, after a long (and continuing) period of reconciliation regarding COVID costs and delays, price escalation is becoming an urgent issue for global construction.

On top of COVID-driven inflation and delays, the commercial fallout of the conflict in Ukraine forced global supply chains and financing arrangements to adapt almost overnight, with an immediate impact on price-influencing fundamentals such as energy, iron/steel and other base metals. Unnervingly, a potentially similar economic shock could evolve from the increasingly tense international relations between China and Taiwan.

In this context, contractors and subcontractors are not only looking for ways to manage cost increases under existing contracts, but also becoming aware that if their future contracts do not provide for the risk of price escalation in the coming years, it could lead to further problems.

What is ‘price escalation’?

Price escalation is sometimes known as ‘cost escalation’ or ‘material price escalation’. It refers to the sensitivity of construction contracts to the prices of materials and labour. In any fixed-price contract, the impact of rising costs in the supply chain will have a direct consequential impact on a contractor’s margin and cashflow. Under variable-price contracts, these are passed on to the Employer, with similar effects.

It is unusual to see variable pricing in major international projects, in part because such projects are typically dependent on financing from institutions. Often these institutions mandate the contractual arrangements on projects they finance but, even if not the case, project finance is generally based on detailed risk assessments that view open-ended, uncertain cost structures unfavourably.

New ‘target cost’ contracts are hybridising these contract models to an extent, essentially by providing a cost-reimbursable structure subject to a cap. Although these arrangements are enjoying some success in smaller domestic projects, it remains to be seen whether such arrangements will be used internationally.

As a result, all contract models are impacted by price escalation, but it is often contractors that bear the brunt.

Types of contracts

The type of contract usually informs as to which party takes the risk of price fluctuations. In reimbursable or cost-plus contracts, the employer takes the risk. The contractor is reimbursed the actual cost, plus allowances for overheads and profit. If the contractor’s actual costs increase, the contract price will increase also.

In remeasurement contracts and fixed price/lump sum contracts the contractor usually takes the risk unless there is a mechanism for cost adjustment. In remeasurement contracts (such as the FIDIC Red Book – For Building and Engineering Works Designed by the Employer) the contract price is based on approximate quantities and a schedule of rates and prices. But, if the rates and prices can be adjusted where price fluctuations occur, the contract price is recalculated using the new rates and prices and the final agreed quantities. The actual work done is remeasured when the works are completed. In fixed price/lump sum contracts (such as the FIDIC Yellow Book – Plant and Design Build) the contractor provides an overall figure, ‘a lump sum’, for all the works that are agreed to be carried out under the contract. But, if the amounts due to the contractor can be adjusted where price fluctuations occur, the contract price is recalculated

Escalation clauses

A mechanism for cost adjustment is, potentially, a more reliable way to limit the contractor’s risk. In the FIDIC 1999 editions the escalation clause is at Sub-Clause 13.8, and in the FIDIC 2017 editions it is at Sub-Clause 13.7. Sometimes the escalation clause is deleted or modified. Sub-Clause 13.8 of the FIDIC 1999 editions (or Subclause 13.7 in the FIDIC 2017 editions) is an ‘opt-in’ clause. It applies only if:

1. Under the FIDIC Red and Yellow Books 1999 – a table of adjustment data is included in the Appendix to Tender.

2. Under the FIDIC Silver Book 1999 – provided for in the Particular Conditions.

3. Under the FIDIC 2017 forms – a Schedule(s) of cost indexation is included in the contract.

The table of adjustment data or Schedule(s) is a complete statement of the adjustments to be made to the cost of labor, goods and other inputs to the Works (for example, fuel). Any other rises or falls in the Costs are deemed to be included within the Accepted Contract Amount. No adjustment is applied to work valued on the basis of Cost or current prices. Where it applies:

1. Under the FIDIC 1999 editions – the amounts payable to the contractor are adjusted for both rises and falls ‘in the cost of labor, goods and other inputs to the Works’ by adding or deducting amounts calculated in accordance with a prescribed formula (in the FIDIC Red and Yellow Books) or as set out in the Particular Conditions (in the FIDIC Silver Book).

2. Under the FIDIC 2017 editions – the amounts payable to the contractor are adjusted for both rises and falls ‘in the cost of labor, Goods and other inputs to the Works by adding or deducting amounts calculated in accordance with the Schedule(s).

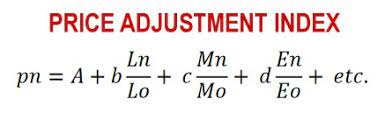

In the FIDIC Red and Yellow Books 1999 a formula is set out, but this may be amended as the parties choose. The wording states: ‘The formulae shall be of the following general type’. The formula is as follows:

The n in the above formula refers to a defined period. This is usually the relevant payment period and so will typically be the month of the payment application. The o refers to the base date. Therefore, it applies the difference between the base index and the current index to the adjustable price element, bringing the contract price up in line with the change in the index (or down, if de-escalation is permitted).

It is recognised that the formula set out above to calculate the adjustment multiplier (Pn), which is to be applied to the estimated contract value, is crude, but it is a fast and reasonably credible way of calculating and reimbursing fluctuations in costs. The formula relies on:

1.A fixed element (a), representing the nonadjustable portion in contractual payments, which is fixed at the time of Contract. FIDIC suggests 10% in the Appendix to Tender or Guidance.

2.The weighting of the resources (b) (c) (d), which is determined at the time of contract. For example, a road project might be 20/40/40 for labour, equipment and materials.

3. Cost indices for the current ‘now’ value (n) and the original value (o) for each of, for example, labor (L), equipment (E) and materials (M), which need to be updated frequently (preferably monthly rather than quarterly or annually, but that will depend upon the cost indices chosen).

The mathematics involved are, therefore, relatively straightforward but the output of any formula is naturally dependent on the inputs which, although mathematical, are contractually defined. Consequently, both contractual and commercial review are essential.

The FIDIC Silver Book 1999 and the FIDIC Gold Book 2008 do not set out a formula. The FIDIC Silver Book Guidance suggests that the wording for provisions based on the cost indices in the FIDIC Yellow Book be considered. The FIDIC 2017 editions do not set out a formula either. The Guidance states: ‘It is recommended that the Employer be advised by a professional with experience in construction costs and the inflationary effect on construction costs when preparing the contents of the Schedule(s) of cost indexation’

What needs to be considered?

Careful attention should be given to define key variables, such as:

- The base date and/or start date

- Triggers for applying the clause

- Any caps on price increases

- Any non-adjustable portion

- Cost elements and weightings

- The relevant reference indices

- Whether different formulae are required for different costs

- Currency variables, if needed

- Any provisions for price de-escalation

The price adjustment clause can directly define the commercial success of the project for the contractor in an inflationary environment. As a prime example, triggers for price adjustment often require a certain degree of increase before the clause is engaged, while a cap may prevent any cost above a certain degree of increase being passed on. This effectively creates a window of defined margin on certain core costs, and allocates an open-ended risk above the cap.

Conclusion

In the current macroeconomic environment, contractors are increasingly concerned about how to handle recent cost increases, which are unprecedented in the modern era. For contracts without a price escalation clause, a detailed contract review may provide avenues to recover certain costs under other headings such as change of law, force majeure, or the variation procedures. Local law may also allow recovery, depending on the jurisdiction.

In severe circumstances, commercial negotiation may become a necessity if the contractor is in risk of default, or if there are other risks to the project. Negotiated arrangements seen in practice include new financing, allowing some of the contractor’s proven costs to be deducted from liquidated delay damages, or new lump-sum contracts for work packages which are then removed from the main contract. All of these options are fraught with legal and commercial dangers and can bring further contentious issues if not handled carefully.

With a view to the future, including price escalation clauses in contracts may seem disadvantageous to employers, as they are accepting the risk of increasing costs. However, price escalation clauses allow contractors to bid more accurately and competitively, resulting in lower bid prices for the employer. It also opens the door to price de-escalation, which would favour the employer if deflationary trends prevail during the project.

Ultimately the most immediate benefit is that the project will not be endangered by contractor defaults, or contractor delays related to procurement and delivery issues arising from cost increases. In this regard, it should be borne in mind that the contractor’s delay is usually subject to liquidated delay damages, whereas the employer’s delay liability to other contractors is usually, at least theoretically, unlimited.

Although it may seem like a risk for employers to accept price escalation clauses, the current and continuing uncertainty in global supply chains may cause havoc on future projects if not appropriately provided for in the contract. In this respect, the certainty provided by price escalation clauses has significant value in itself.

Leave a Reply